Choosing the Right Organizational and Legal Form for Your Business

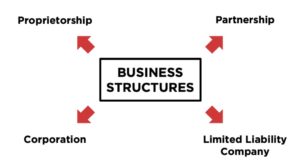

All business in the world fits into several organizational and legal forms. Each of them determines the scale, opportunities, and degree of participation in the production of goods and services. One of the most popular legal forms is LLC (Limited Liability Company). You can opt for this type of business structure that is beneficial to your business.

A good llc filing service can help you in forming or converting your business to such an entity. It is customary to distinguish between three basic forms of business organization:

help you in forming or converting your business to such an entity. It is customary to distinguish between three basic forms of business organization:

- individual;

- collective;

- corporate

All other varieties somehow fit into one of them. The correct choice of organizational and legal form depends on:

- the possibility of specialized activities,

- availability of funding,

- the procedure for distribution of profits,

- responsibility to creditors.

Choosing a Business Organization Form and Legal Status

The form of doing business is chosen based on several considerations. They are guided by financial, organizational, and legal bases. The main selection criterion is the ability to attract finance. In second place is the profile factor – for example, production, trade, services, mediation. The third factor is state requirements for the organization and conduct of activities in a specifically chosen form.

The organizational and legal form establishes the rights and degree of participation of owners (founders, holders), establishes the legal status of a company or entrepreneur, introduces the conditions for its creation, registration, management, and liquidation. The legal position allows you to establish the measure of responsibility of business participants, distribute this responsibility in the event of bankruptcy, and divide the functions of participants by the right of decision-making.

Legal Entities and Individuals in Terms of Legal Status

According to the legal status, subjects can be classified as individuals or legal entities. The first are entrepreneurs and self-employed, capable persons who have the right to conclude transactions. They are obliged to be responsible to counterparties and consumers. They have the right to dispose of property and resources necessary for the business. The responsibility of the entrepreneur and the self-employed applies to all of their property.

status, subjects can be classified as individuals or legal entities. The first are entrepreneurs and self-employed, capable persons who have the right to conclude transactions. They are obliged to be responsible to counterparties and consumers. They have the right to dispose of property and resources necessary for the business. The responsibility of the entrepreneur and the self-employed applies to all of their property.

Legal entities have property rights and obligations. They can act on their own behalf, being formed as a group of individuals united by common interests and entered into economic and financial relations. At the same time, the property of the company (legal entity) is separated from the personal property of each individual. Take your time to identify the right legal structure for your business.…

Each type of entrepreneurship has its own positive and weak sides, which can be associated with both the registration procedure and the further conduct of the business. In medium and small companies, they usually use the form of LLC or IE. The main difference between these two legal forms is in the terms of the contract between the state and the entrepreneur.

Each type of entrepreneurship has its own positive and weak sides, which can be associated with both the registration procedure and the further conduct of the business. In medium and small companies, they usually use the form of LLC or IE. The main difference between these two legal forms is in the terms of the contract between the state and the entrepreneur. As a rule, online store owners open their business as an individual entrepreneur on a simplified tax system. Usually, such work does not require renting an office and hiring a large staff. To open an online store in the form of an individual entrepreneur, you will need to open a current account for more convenient work with clients. Registration of the online store is carried out at the place of residence without a lawyer’s assistance.

As a rule, online store owners open their business as an individual entrepreneur on a simplified tax system. Usually, such work does not require renting an office and hiring a large staff. To open an online store in the form of an individual entrepreneur, you will need to open a current account for more convenient work with clients. Registration of the online store is carried out at the place of residence without a lawyer’s assistance.